Trade withmarket intelligencenot noise.

SteadyMint Syndicate runs a disciplined BTC/ETH/SOL/AVAX execution stack: deterministic intelligence engines, a strict risk gate, dynamic leverage, and audit-grade logging — wrapped in a clean Member portal.

Dynamic Leverage

Leverage adapts per trade based on regime, volatility, microstructure, drawdown & behavior caps.

Safety First

RiskGuardian pre-trade gate + invariant checks + a global kill switch when conditions degrade.

Min. deposit: $5,000 · Performance fees on profits only

Crypto is volatile. Losses are possible, including substantial loss. Nothing here is a promise of returns — it's a description of the system and the rules used to operate it.

SteadyMint Syndicate

A full-stack trading system — not a manual "admin fund"

Members get a simple portal experience. Under the hood, the backend behaves like an institutional execution pipeline with strict gating, deterministic intelligence, and audit-grade records.

Market Intelligence Stack

Multi-engine context: AlphaEngine + MIREngine + ShadowEngine + Projection (Prescience). Built for deterministic signals, regimes, and replay.

Dynamic Leverage (LevV1)

No fixed leverage. Sizing adapts to volatility zones, microstructure quality, drawdown throttles, and behavior/stress caps — per trade.

Pre-Trade Risk Gate (RiskGuardian)

Final execution gate that blocks, reduces size, or approves with reasons. Designed to keep "bad trades" from ever becoming orders.

Execution Safety & Kill Switch

OMS-style execution spine, idempotency, invariant checks, and a global kill switch. If something looks wrong, the system halts.

Market Intelligence

Multiple engines. One decision.

Intelligence is built to be deterministic first. Optional AI explanations can exist, but the decision path stays rule-based, replayable, and auditable.

AlphaEngine

Signal + EV summary

Liquidity-aware alpha cues and opportunity scoring to avoid chasing noise.

MIREngine

Regime & risk diagnostics

Microstructure, volatility zones, trend/systemic pressure, and hard-halt conditions.

ShadowEngine

Execution planning (shadow mode)

Simulates plans, checks feasibility, and selects execution mode before capital is committed.

Projection

Prescience (snapshot-bound)

Projection updates are gated; replay uses snapshot binding + hashes for audit-grade equivalence.

Determinism & Replay

Decisions are bound to snapshots & hashes

Market context can be snapshot-bound, hashed, and replayed to reproduce the same outputs — useful for audit trails, dispute resolution, and improving the system without rewriting history.

Binding

snapshotId + barOpenTs

projection binding hash

Evidence

payloadHash v2

MI stream persisted

At a Glance

Clear terms, simple member experience

Behind the scenes is complex. For members, the rules are simple: weekly settlement, pro-rata allocation, fees on profits only, and transparent portal history.

Minimum Starting Deposit

$5,000

Balances are tracked in USD inside the portal. You can add funds weekly, monthly, or irregularly — they're integrated into the next suitable cycle.

Performance & Fees

Weekly cycles & 25% fee

Pool performance is calculated weekly. Profits/losses allocate pro-rata based on each Member's balance. A 25% performance fee applies only when the pool is in net profit.

Withdrawals & Horizon

Weekly rhythm, flexible

Standard withdrawals process at settlement. Emergency requests draw from reserve when conditions allow. Best suited to a 3–6+ month horizon — not short-term cash needs.

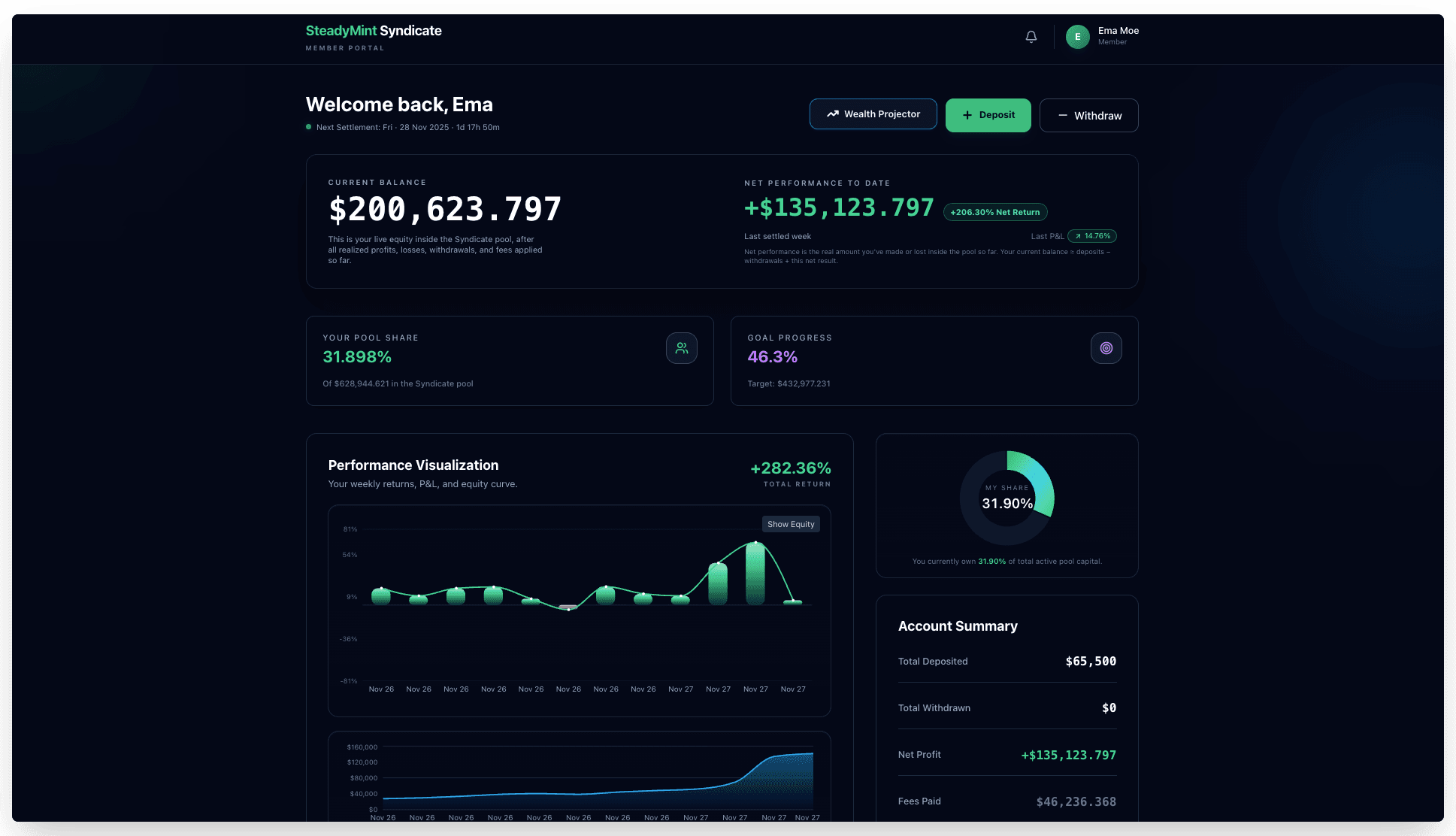

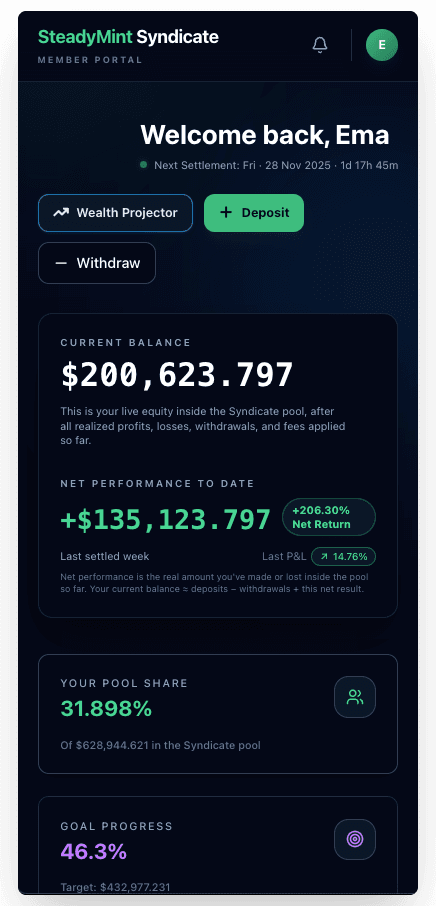

Inside the Portal

Clean reporting. No exchange chaos.

Members log in to a private dashboard to see balance, deposits, withdrawals, and cycle-by-cycle performance. The system does the heavy lifting — the portal keeps it clear.

Screenshots below are real interface previews. Layout may evolve, but transparency stays the point.

Risk & Leverage

Dynamic leverage replaces fixed leverage

We don't lock the system into a single leverage number. The leverage recommendation is computed per trade (LevV1Engine) and then constrained by policy caps, market stress, drawdown throttles, and behavioral guardrails.

What "dynamic" means

More conservative when conditions worsen

Volatility spikes, disorderly microstructure, funding pressure, drawdown thresholds, or trader "tilt" signals can reduce leverage or block trades entirely — before orders are created.

Volatility zones

Leverage is capped by the current volatility zone (LOW → EXTREME) to avoid overexposure in chaotic markets.

Microstructure quality

Spread, slippage risk, and disorder penalize leverage. Low-quality execution conditions force smaller size.

Drawdown throttles

Daily/weekly drawdown rules can cap leverage, reduce risk budget, or block new trades until stability returns.

Behavior & stress caps

Tilt/fatigue/checklist scores can throttle aggression. The system protects the pool from human emotion.

Execution Spine

Orders are not "sent." They're governed.

The backend is designed like an OMS/execution pipeline: intents, orders, fills, and position truth — with reconciliation, idempotency, and audit events.

ExecutionIntent → Orders → Fills → PositionState

A spine-style pipeline that turns a decision into a traceable position state (with reconciliation back to exchange truth).

Idempotency & deterministic order IDs

Client order IDs + DB idempotency prevent duplicate orders, especially under retries and network volatility.

Invariant checks + event logs

If reconciliation drift or impossible states appear, the system emits violations and can trigger safety escalation.

Global kill switch

Manual or automated halt. When activated, trading paths are blocked to protect capital during uncertainty.

Safety rule

If it can't be replayed/audited, it's not "real money"

Exchange ingest snapshots, system events, and invariant violations exist to make decisions explainable, reproducible, and accountable over time.

Audit Trail

SystemEvent

decision + execution logs

Safety Net

InvariantViolation

drift detection

Participation Flow

Simple onboarding, governed operation

The portal keeps things simple. The backend keeps things strict: gated decisions, weekly settlement, and transparent record-keeping.

Request access

Invitation-only. New participants submit a short form and are approved individually based on fit and risk understanding.

Sign terms & risk disclosure

You review and sign the Participation Agreement and Risk Disclosure, confirming you understand there are no guarantees.

Deposit & allocation

Fund your account (min. $5,000). Deposits are integrated into the next suitable cycle. Everything is confirmed in-portal.

Weekly cycles & withdrawals

Each cycle, performance is calculated and allocated. Standard withdrawals follow the settlement rhythm; emergencies use reserve when possible.

Planning Tool

Explore hypothetical growth for your balance

This mini projector lets you see how simple math behaves with different deposit sizes and net weekly performance. It is not a promise or forecast — just a way to think about compounding over time.

Inside the portal, Members get access to the full Wealth Projector with monthly contributions and longer horizons.

Wealth Projector (Lite)

One-time deposit scenario

Starting Deposit

$1,000Hypothetical Net Weekly Result

3.0%Negative values simulate losing stretches; positive values simulate winning stretches. Real markets move.

Time Horizon

12 weeksHypothetical End Balance

$1,426

Starting

$1,000

Hypothetical Profit

+$426

This is a simple compounding example. Actual performance may differ significantly and can be lower, higher, or negative. This does not represent expected or promised returns.

Structure & Risk

Private arrangement. Clear rules. Real risk.

SteadyMint is not a public fund or product. It's a private, invitation-only arrangement with explicit written terms and risk acknowledgments. Crypto markets are volatile.

Disciplined execution

Decisions and leverage live inside defined risk parameters. The goal is disciplined participation — not constant aggression, not chasing hype, and not gambling on single trades.

Aligned incentives

No management fee. Performance fee applies only on net profits. When the pool is flat or down, no performance fee is charged.

Liquidity with guardrails

A reserve supports emergency withdrawals when conditions allow. In extreme volatility, withdrawals may be sequenced to avoid forced exits at the worst time.

Clear risk disclosure

You acknowledge losses are possible (including significant loss). This is not a savings account, and returns are never guaranteed.

Getting Started

Onboarding timeline & who it's for

The process is intentionally simple but not instant. The goal is to ensure you understand the rhythm, the risks, and whether this truly fits your situation.

Typical timeline

- Day 0–1: Request access, brief conversation if needed.

- Day 1–2: Review & sign Terms and Risk Disclosure if approved.

- Day 2–4: First deposit received and reflected in your portal.

- Next cycle: Your balance participates in trading performance.

Who this is for

- People comfortable with real market volatility.

- Those who want crypto exposure but don't want to trade themselves.

- Participants who can leave funds to work over multiple cycles (months, not days).

- Individuals who value discipline and risk control over hype.

Who this is not for

- Anyone seeking guaranteed or fixed returns.

- People relying on this money for near-term expenses or emergencies.

- Those who cannot tolerate account value going down, sometimes sharply.

- Anyone uncomfortable with a private, invitation-only, non-regulated arrangement.

Questions

Frequently asked (and honestly answered)

This is not for everyone. The answers are direct so you can decide if SteadyMint fits your risk tolerance and expectations.

Is SteadyMint a regulated fund or public investment product?

No. SteadyMint is a private, invitation-only arrangement among known individuals. It is not offered to the public and has no investor compensation scheme.

Are returns guaranteed?

No. Returns are never guaranteed. Performance varies from week to week, and losing periods are expected.

Is leverage fixed?

No. The system uses dynamic leverage (LevV1) — leverage can increase or decrease based on market regime, volatility zones, execution quality, drawdown throttles, and behavioral/stress guardrails.

How are profits and losses allocated?

Pro-rata based on each Member's balance. If the pool is up or down, your balance moves by that same net percentage (before any performance fee on profitable weeks).

Can I add more money weekly or monthly?

Yes. You can deposit weekly, monthly, or irregularly. New capital is typically integrated into the next suitable cycle, with full portal history.

When can I withdraw?

Standard withdrawals process at weekly settlement. Emergency requests draw from reserve when conditions allow; extreme volatility can slow or sequence withdrawals to avoid forced exits.

Do you have a "kill switch"?

Yes. There is a global kill switch and safety checks (including invariant detection). The system is designed to halt trading when conditions become uncertain or inconsistent.

Still unsure if this fits you?

Request access and ask questions before signing or sending funds. It's better to say no early than to join something misaligned with your risk tolerance.