Managed exposure todisciplined digital asset strategies.

SteadyMint Syndicate is a private trading pool for a small circle of trusted participants. No hype, no fixed-income promises just structured risk, capped leverage on BTC/ETH, and transparent weekly reporting for people who don't want to manage trades themselves.

Minimum starting deposit: $300. Performance fees are charged only on net profits for a positive cycle. This is not suitable if you rely on this money in the short term.

Strategy Snapshot

Max leverage: 3× on BTC/ETH

Core Principles

- Performance fee applies only on net profits.

- No performance fee in break-even or losing cycles.

- Liquidity reserve typically 5-10% of pool value to support emergencies.

Illustrative Scenario (Not a Promise)

If a member deposited $1,000 and the pool averaged 5% net performance per week for 12 weeks, their balance before any new deposits and after a 25% performance fee on profits would be around $1,600. This is just math, not a projection or guarantee actual results can be lower, higher, or negative.

At a Glance

Key terms & structure in one view

A simple framework: capped leverage, weekly performance cycles, and clear pro-rata fee logic. You always see how your share is calculated in the portal.

Minimum Starting Deposit

$300

Balances are tracked in USD inside the portal. You can add more funds over time weekly, monthly, or irregularly and they'll be integrated into the next suitable cycle.

Performance & Fees

Weekly cycles & 25% fee

Pool performance is calculated weekly. Profits or losses are allocated proportionally based on each Member's balance. A 25% performance fee applies only when the pool is in net profit.

Withdrawals & Horizon

Weekly rhythm, flexible

Standard withdrawals are processed at settlement. Emergency requests draw from the reserve when conditions allow. This is best suited to a 3-6+ month horizon, not short-term cash needs.

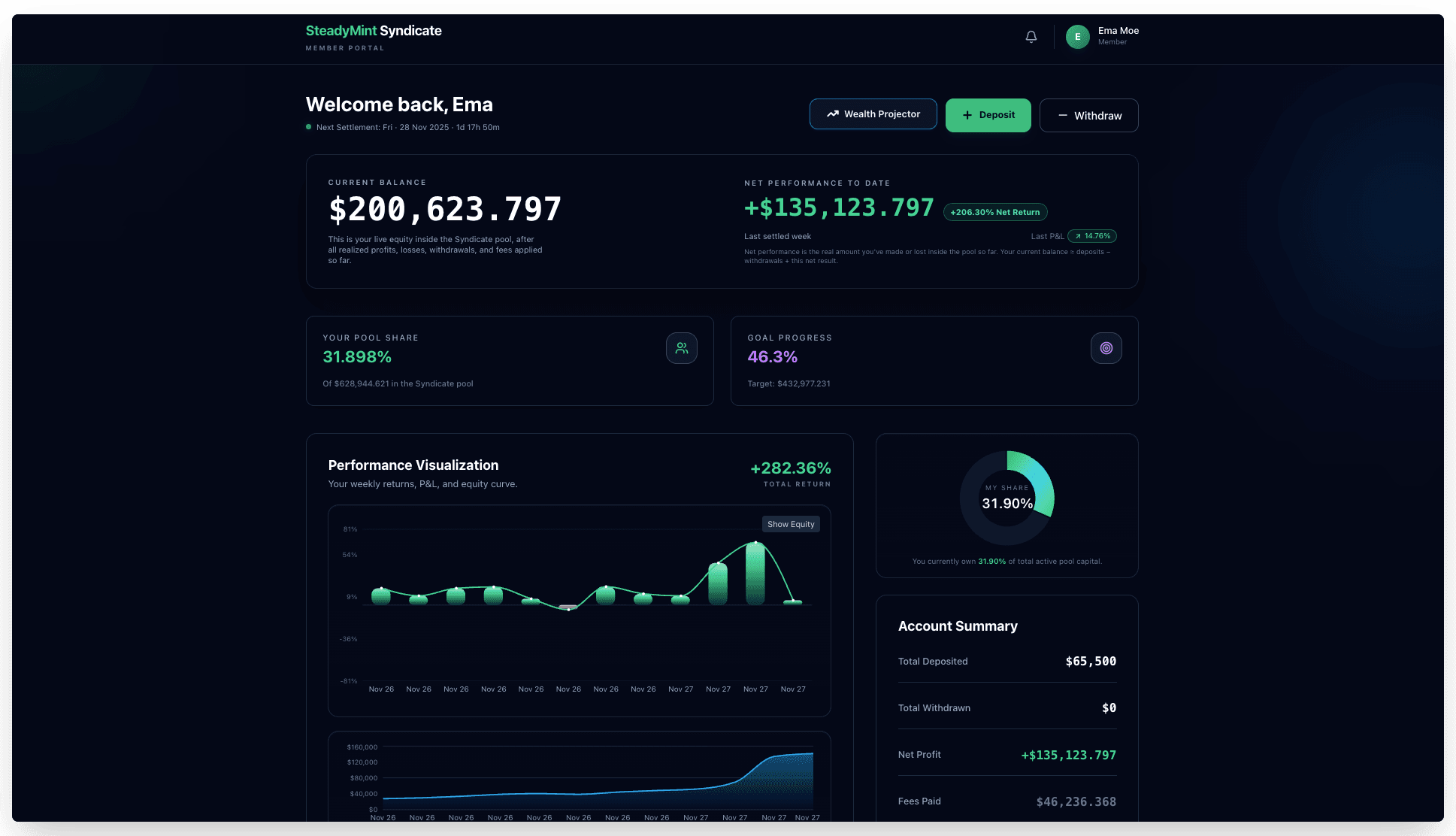

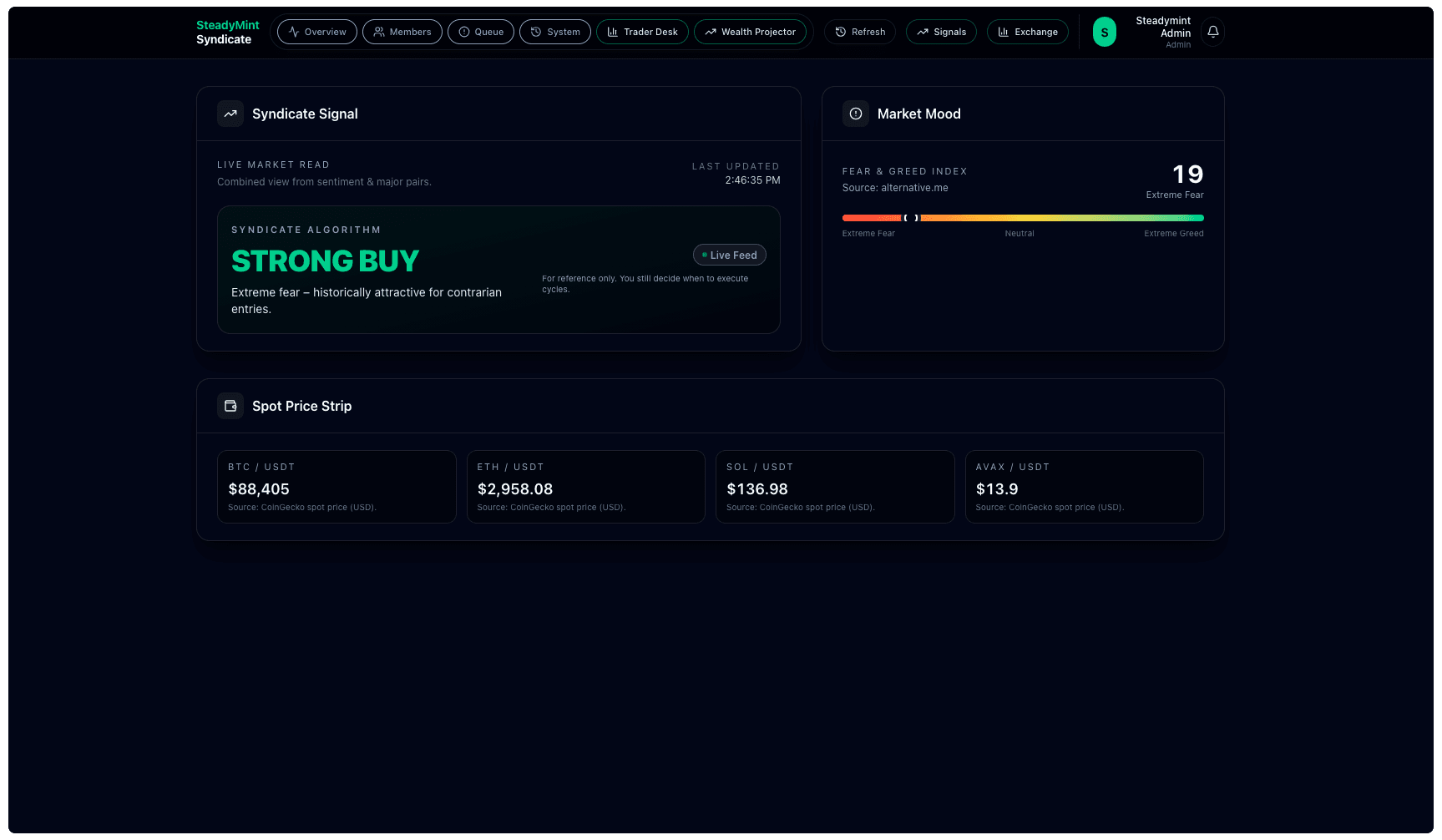

Inside the Portal

See your Syndicate position at a glance

Members log in to a clean, private dashboard not a noisy exchange. You see your balance, deposits, withdrawals, and cycle-by-cycle performance in one place.

The preview below uses real interface screenshots. Exact layout and numbers may change over time, but the focus stays the same: clarity and transparency for Members.

Participation Flow

How the Syndicate operates

Members get a simple portal experience; behind the scenes, everything is governed by clear rules and a weekly settlement rhythm.

Request access

Membership is by invitation and existing relationship. New participants submit a short form and are approved individually based on fit and risk understanding.

Sign terms & risk disclosure

You review and sign the Participation Agreement and Risk Disclosure, confirming you understand there are no guarantees and losses are possible.

Deposit & allocation

You fund your account (min. $300). Deposits are integrated into the pool and deployed according to the current strategy. Details are confirmed via the portal and email.

Weekly cycles & withdrawals

Each cycle, performance is calculated, allocated, and fees (if any) are applied. Standard withdrawals follow this rhythm; emergencies draw from the reserve when conditions allow.

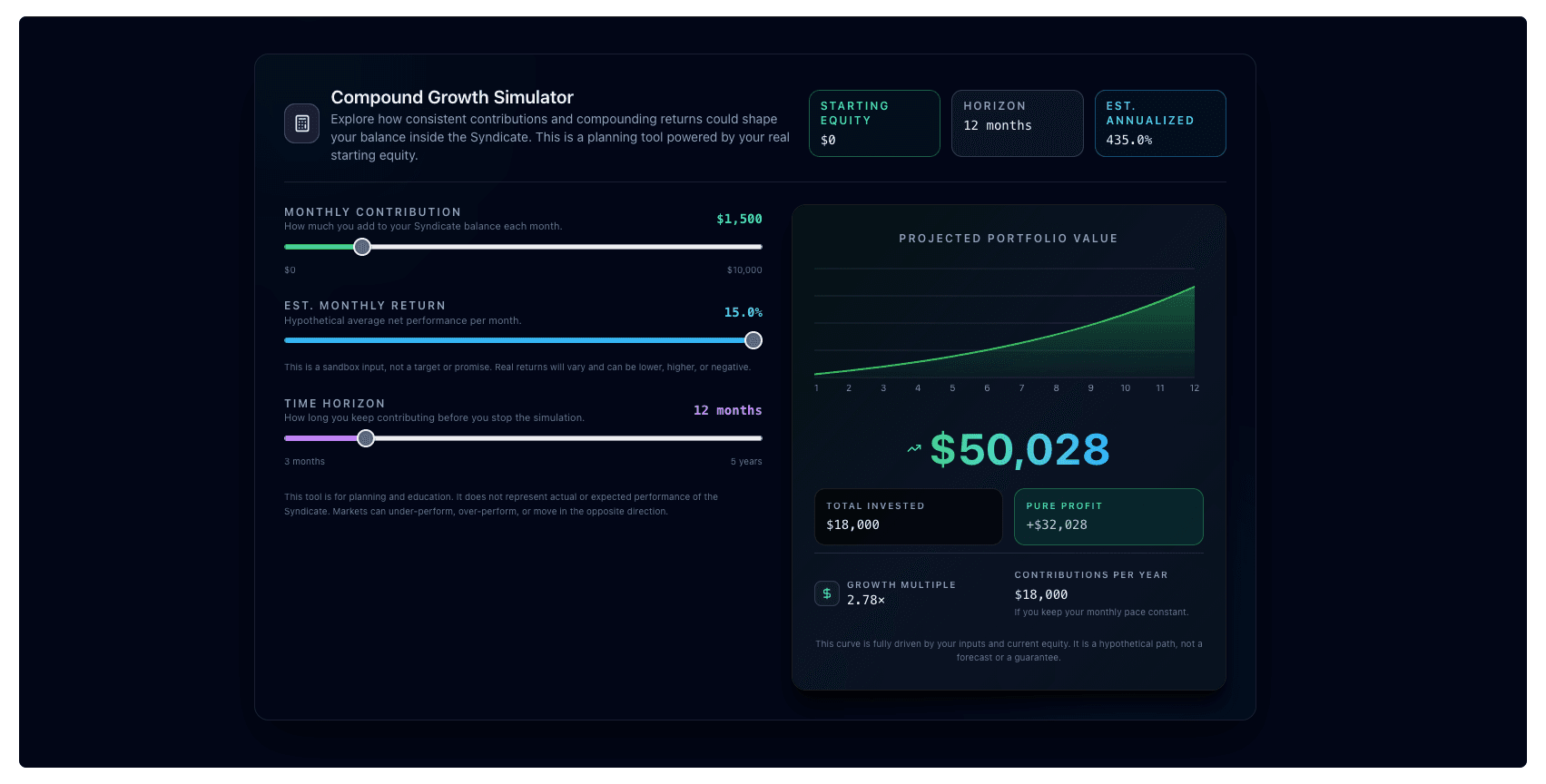

Planning Tool

Explore hypothetical growth for your balance

This mini projector lets you see how simple math behaves with different deposit sizes and net weekly performance. It is not a promise or forecast just a way to think about compounding over multiple cycles, from a few weeks up to several years.

Inside the portal, Members get access to the full Wealth Projector with monthly contributions and longer horizons.

Wealth Projector (Lite)

From a few weeks to ~5 years, one-time deposit scenario

Starting Deposit

$1,000Hypothetical Net Weekly Result

3.0%Negative values simulate losing stretches; positive values simulate winning stretches. Real markets move.

Time Horizon

12 weeksHypothetical End Balance

$1,426

Starting

$1,000

Hypothetical Profit

+$426

This is a simple compounding example. Actual Syndicate performance may differ significantly and can be lower, higher, or negative. This does not represent expected or promised returns.

Compounding & Mindset

Why compounding feels slow… until it doesn’t

Human intuition expects straight lines: add a bit, get a bit. But compounding grows slowly, then suddenly, and most of the important gains show up late after a long stretch that feels like “nothing is happening.”

The “hockey-stick” effect

Early on, compounding feels boring: changes are small and easy to ignore. As the base grows, the same percentage move affects a larger amount and the curve bends upward. The biggest gains often show up late.

Our brains expect straight lines

Humans intuit linear change. Exponential growth feels “wrong” even when the math is right. This bias makes compounding hard to perceive.

Short-term vs long-term

Our biology favors short-term safety and quick wins. Compounding rewards patience most people quit in the “boring middle.”

How this relates to SteadyMint

The Wealth Projector here is a learning tool not a forecast. It shows how compounding behaves under different hypothetical returns.

Markets are volatile. Losses are possible. Long-term outcomes depend on time, discipline, and real market behavior not sliders.

Compounding is powerful precisely because it’s hard to “feel” working in real time. We’d rather you understand that early than chase unrealistic expectations.

Structure & Risk

A private arrangement with clear rules.

SteadyMint is not a public fund or product. It's a structured way for a small circle to gain exposure to actively managed BTC/ETH strategies, with explicit written terms and risk acknowledgments.

Disciplined trading

Trading decisions, asset selection, and leverage are at the Manager's discretion within the risk parameters shared with Members. The focus is on consistency and downside control, not constant aggression or chasing hype.

Aligned incentives

Performance fees apply only in profitable periods. When the pool breaks even or takes a loss, no performance fee is charged. The Manager participates alongside Members and shares the same market reality.

Liquidity with guardrails

A 5-10% reserve supports emergency withdrawals when conditions allow. During extreme volatility, withdrawals may be slowed or sequenced to avoid forced liquidations at bad prices.

Transparent risk disclosure

Before joining, Members review and sign a clear Risk Disclosure and Terms document. It states plainly that crypto trading is highly volatile, that losses including substantial or total loss are possible, and that this should not be treated like a savings account.

Human + System

How our tech" works with real judgment

Under the simple client portal is a stack of tools we half-jokingly call our "alien tech" layer. It's not magic. It's a set of systems designed to make decisions clearer, risk smaller, and behavior more disciplined while keeping a human in the loop.

1 · Glass Box Analyst

See the thinking, not just the trade

Every decision is logged as a Trade Card with a clear thesis: what changed, why it matters, and where we're wrong. As the platform evolves, AI helps turn raw market data and trader notes into member-friendly explanations instead of black-box signals.

- • Signal: what the market is doing.

- • Context: how it fits the bigger picture.

- • Plan: what invalidates the idea if needed.

2 · Shadow Mode

Watch the system before you trust it

Shadow Accounts are designed as a zero-capital way to observe the Syndicate. A simulated balance tracks the same decisions and weekly cycles, so you can study the rhythm of wins, losses, and flat periods before committing real funds.

- • Same logic and reports, simulated capital.

- • Learn the volatility profile without real risk.

- • Clear view of how cycles actually behave.

3 · Trader Neuro-Check

Guardrails that protect the pool from emotion

The internal cockpit is built with a Neuro-Check layer that looks for over-trading, revenge trades, and rule-breaking behaviour. If conditions suggest tilt, the system can slow things down with smaller size, extra confirmation, or a cooldown.

- • Monitors streaks, drawdowns, and trade frequency.

- • Enforces the rulebook when emotions run high.

- • Keeps a human in control with a system as co-pilot.

Internally, we joke about this stack as our "alien tech" layer. In practice, it's just our way of combining human judgment with systems that enforce discipline, document decisions, and make the whole process easier to understand for the people who have trusted us with their capital.

Stewardship

Who manages the Syndicate?

Steady Mint is run by dedicated Managers who actively trade the pool and participates alongside Members with personal capital at risk. The goal is not to "get rich overnight" but to treat your capital with the same care and respect as personal funds.

Background & focus

The Manager has several years of hands-on experience trading BTC and ETH with a strict emphasis on capped leverage, risk per trade, and avoiding catastrophic drawdowns. The approach is systematic, not impulsive patience and risk control matter more than calling every top or bottom.

Alignment & transparency

There are no management fees only a performance fee when the pool is profitable. Every profit, loss, and fee is logged in the portal, so each Member can see their full history of deposits, withdrawals, and cycle-by-cycle changes at any time.

Active Intelligence

Powered by Data, Not Emotion

While human judgment makes the final call, the Syndicate relies on a proprietary Market Intelligence Engine. By aggregating real-time sentiment, price action, and volatility metrics, we filter out the noise ensuring every trade is backed by data, calculated risk, and disciplined execution.

Getting Started

Onboarding timeline & who it's for

The process is intentionally simple but not instant. The aim is to make sure you understand the rhythm, the risks, and whether this actually fits your situation before you commit.

Typical timeline

- Day 0-1: Request access, brief conversation if needed.

- Day 1-2: Review & sign Terms and Risk Disclosure if approved.

- Day 2-4: First deposit received and reflected in your portal.

- Next cycle: Your balance participates in the Syndicate's trading performance.

Who this is for

- People comfortable with real market volatility.

- Those who want crypto exposure but don't want to trade themselves.

- Participants who can leave funds to work over multiple cycles (months, not days).

- Individuals who understand that discipline and survival matter more than one big win.

Who this is not for

- Anyone seeking guaranteed or fixed returns.

- People who rely on this money for near-term expenses or emergencies.

- Those who cannot tolerate account value going down, sometimes sharply, during volatility.

- Anyone uncomfortable with a private, invitation-only, non-regulated arrangement.

Questions

Frequently asked (and honestly answered)

This is not for everyone. The answers are intentionally direct so you can decide if the Syndicate fits your risk tolerance and expectations.

Is SteadyMint a regulated fund or public investment product?

No. SteadyMint Syndicate is a private, invitation-only arrangement among known individuals. It is not a registered fund, not a security, and not offered to the public. There is no regulatory oversight or investor compensation scheme.

Are returns guaranteed?

No. Returns are never guaranteed. Performance will vary from week to week, and losing periods are expected. You should not participate if you are seeking fixed or guaranteed income.

If the pool makes 15%, do I get 15% on my balance or a slice of the whole?

You get the pool’s net percentage move applied to your own balance. For example, if the pool is $100,000 and your share is $1,000 (1%), and the pool is up 15% net for the week, your $1,000 becomes $1,150 before any performance fee. Profits and losses are always allocated pro-rata based on each Member’s balance.

Can I add more money weekly or monthly?

Yes. You can request additional deposits as often as you like weekly, monthly, or irregularly. New capital is typically integrated into the next suitable cycle. The portal keeps a full history of when each deposit entered the pool and how it has performed since.

Can I partially withdraw or just take profits?

Yes. You can request partial withdrawals, including just taking some profit while leaving your base capital in. These are processed during the standard settlement window unless explicitly agreed otherwise. Withdrawals reduce your share of the pool going forward.

When and how can I withdraw everything?

You can request a full exit through the portal. Standard exits are processed at weekly settlement and may be sequenced if markets are extremely volatile. The aim is to respect your request while avoiding forced liquidations at the worst possible times.

What kind of returns should I mentally prepare for?

There is no “should.” The Syndicate aims for disciplined, risk-aware participation in BTC/ETH markets not for guaranteed percentages. Some periods may see strong gains, others may be flat or negative. The key premise is surviving volatility and compounding over time, not winning every single week.

Do I get any tools to plan my own goals?

Yes. Inside the client portal, Members can use the Wealth Projector a planning tool that lets you explore hypothetical scenarios with different contribution levels and net performance assumptions. It is for education and planning only, not a promise of actual outcomes.

Who is this for and who is it not for?

This is for people who understand that crypto carries real downside risk, who are comfortable with volatility, and who want disciplined exposure without managing trades themselves. It is not for anyone who needs short-term certainty, guaranteed income, or emotional comfort from markets.

Why does it feel like my balance isn’t growing much at first?

Because that’s exactly how compounding works at the beginning. Early on, your balance is still relatively small, so even a positive percentage move doesn’t change the absolute number very much. It can feel slow, boring, or “not worth it. Over time, if you stay in and the pool grows, the same percentage move applies to a larger base. That’s when compounding starts to feel powerful but you only reach that stage if you’re comfortable with the risk, the volatility, and the possibility of losses along the way. We don’t promise specific returns at SteadyMint. We do, however, want you to understand the shape of the journey so you’re not surprised by how slow the early part can feel.

Still unsure if this fits you?

You can request access and ask any remaining questions before signing or sending funds. It’s better to say no early than to join something that isn’t aligned with your risk tolerance.